Empowering the market by introducing cutting-edge products

Astana International Exchange (“AIX”, “Exchange”) is pleased to share the results of its 9M2025 performance, marked by the launch of groundbreaking products at the intersection of traditional and digital finance, a robust pipeline of new listings, and significant growth in trading turnover.

In the third quarter of 2025 AIX continued achieving important milestones, such as reaching 500 listings since inception of the exchange and recording year-to-date trading turnover of over US$1 billion.

Assel Mukazhanova, CEO of AIX, noted:

“Recently, AIX has reached another important milestone, reflecting sustainable growth and strong market dynamics. The number of instruments on the AIX Official List continues to grow, demonstrating the increasing confidence of business community and issuers in our platform.”

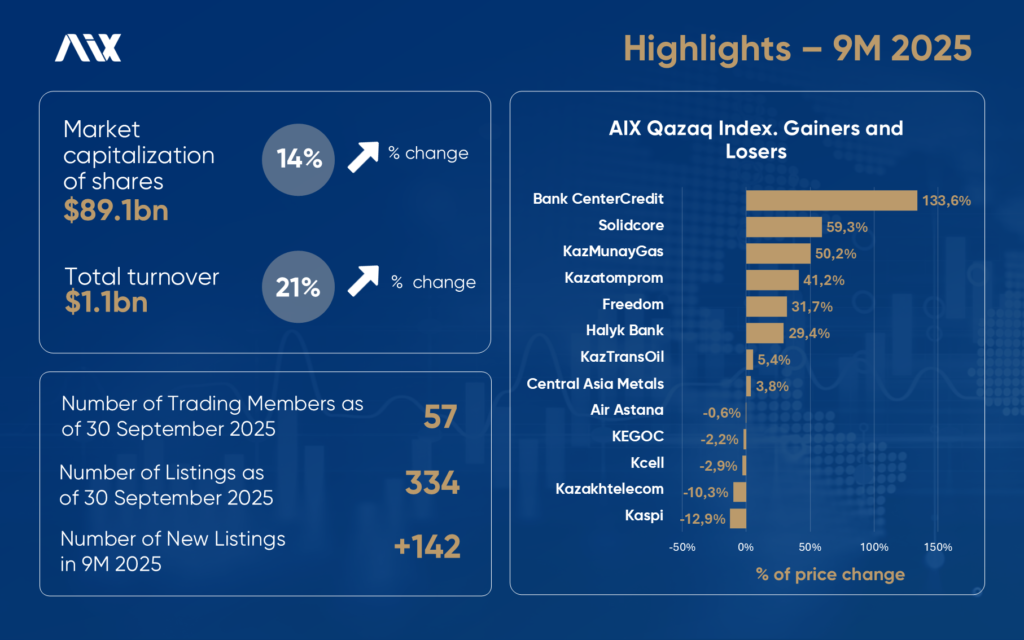

AIX results as of 30 September 2025:

- Securities listings: 334 securities in the AIX Official List by 176 issuers overall. For 9M2025 – 142 new listings of 118 issuers. For comparison, 140 securities were registered in 2024.

- Capital raised: (Debt + Equity): US$10.2bn since inception; US$3.2bn in 9 months of 2025.

- Trading turnover: US$1.1bn vs US$923.4mln in the same period of 2024 (+21%).

- Market participants: 57 trading members, including brokers from Kazakhstan, China, Europe and the Middle East – 6 new brokers were onboarded since the beginning of 2025; 19 custodians – 3 were onboarded in 2025. Ten (10) global custodians maintain sub-accounts at the AIX Central Securities Depository (AIX CSD).

Trading Highlights

Trading turnover demonstrates a sustainable growth trend with over $1bln milestone having been reached on September 9th while in 2024 the same value was reached on October 18th. The structured products (ETF and ETN) trading also showed a sharp increase.

New Listings

The 3Q2025 saw several inaugural products aimed to diversify the local investment landscape and strengthen the Kazakhstan’s visibility on the global digital finance scene.

- The first issuance of commercial papers on AIX – Alatau City Bank becomes the first issuer to register a Commercial Papers Program. The two-tranche program amounts to US$500 mln.

- Eurasia Mining PLC cross-listing from the London Stock Exchange – ordinary shares of Eurasia Mining PLC have been listed and admitted to trading on AIX in July 2025. The Company’s shares are fully fungible between LSE and AIX.

- Groundbreaking Digital ETFs in Central Asia – Fonte Bitcoin Exchange Traded Fund OEIC PLC (BETF), the first spot Bitcoin ETF registered in Kazakhstan and Central Asia, was admitted to trading in August 2025, making AIX the first platform in the region to combine conventional and crypto assets.In September, Fonte Capital Ltd. registered another cutting-edge product – Fonte Solana ETF (SETF) – the world’s first spot ETF fully focused on the digital asset Solana with a staking function. By the end of Q3, the trading volume of BETF and SETF combined exceeded $1,6 mln.

- First AIX/HKEX dual listing – Ordinary shares of Jiaxin International Resources Investment Limited, a tungsten mining company, were simultaneously admitted to listing and trading on AIX and the Hong Kong Stock Exchange, marking the first cross-border IPO between Kazakhstan and China, and the first IPO in Central Asia denominated in Chinese national currency, as well as the first IPO appeared in the “Belt and Road Initiative” segment of AIX. Jiaxin International Resources Investment Limited is a company incorporated in China, which operates exclusively in Boguty mine in the Almaty region of Kazakhstan – the world’s fourth largest tungsten deposit. The final offer price was set at CNY 9.93 and rose to CNY27.81 (2.8x) on the first day of trade.

- The loan participation notes – R Debentures LLC, a Delaware series limited liability company, issued loan participation notes to finance a loan to Deal Drive Car Rental LLC, a technology-driven fintech platform that helps auto dealers in the MENA region and Europe to analyze and manage inventory, pricing, and sales using AI. The placement amounted to US$2 mln, with a 2-year maturity and paying a monthly coupon of 10.25% per annum.

Listing Rules Amendments

- SME Bonds Program – AIX has introduced several enhancements to the Small and Medium-Sized Enterprises (SME) Bonds Program launched in October 2023. The eased requirements are intended to expand SME access to the capital markets. Key changes include extended bond maturity, multi-currency issuance, program-based structure, lower operational history requirements, and removal of sectoral restrictions. Time Building 2050 LLP was the first to tap the market under the updated rules.

- Non–listed securities – Over-the-counter (OTC) transactions of non-listed securities were launched in September 2025. The issuance/settlement/safekeeping services for non-listed securities, where AIX Registrar acts as a primary registrar, are available only for accredited investors and there is no listing or admission to trading on AIX required. The first issuance of non-listed securities was done for the BRIG private equity fund, managed by SQIF AM Ltd, an AIFC-licensed Fund Manager.

Reference:

AIX was formed in 2017 within the Astana International Financial Centre development framework. AIX shareholders are AIFC, the Shanghai stock exchange, the Silk Road Fund, and NASDAQ, which also provides the AIX trading platform. The exchange operates within a regulatory environment based on the principles of English Law, thus providing a reliable investment environment. The mission of AIX is to develop an active capital market in Kazakhstan and the region by providing clear and favorable conditions for attracting financing to private and public businesses. AIX develops special segments for mining companies as well as infrastructure projects under the Belt and Road initiative. www.aix.kz

The Astana International Financial Centre (AIFC) is a leading financial hub in the Eastern Europe and Central Asia region, designed to connect global capital with the vast opportunities of emerging markets. Positioned at the crossroads of Europe and Asia, the AIFC combines international best practices with innovative approaches to create a world-class platform for investment, business, and financial services. Since its establishment in 2018, the AIFC has attracted over USD 15.9 bln in investments into Kazakhstan’s economy. Over 4,000 companies from 80+ countries, including the USA, the UK, China, Turkiye, the Republic of Korea, Singapore, and others, are registered within the AIFC’s jurisdiction. www.aifc.kz